IN THE political cacophony surrounding America’s new tax law, the voice of the private-equity industry has been muted. This is perhaps unsurprising. The industry has managed in large measure to retain its favourable tax treatment, despite a threat from President Donald Trump to close the “carried interest” loophole on which it had grown fat.

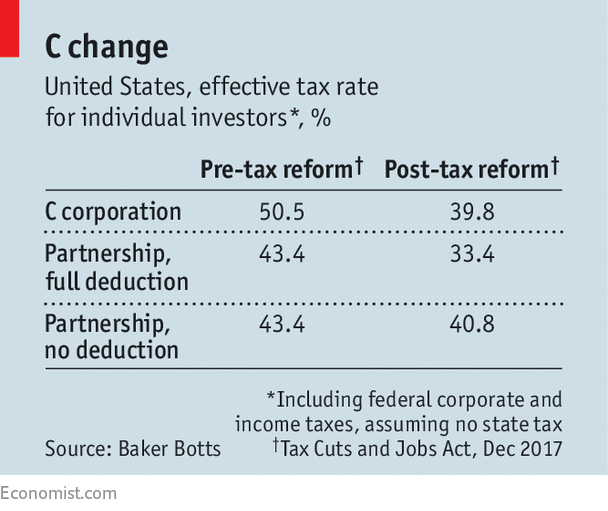

So few expected the announcement on February 8th from KKR, a big private-equity firm, that the new law was prompting it to consider converting its status from that of a partnership to a “C corporation” (a corporate-tax-paying firm). As The Economist went to press, a competitor, Ares Management, was expected to make a similar announcement. The new law may have a lasting impact on private equity after all.

Tax has always been central to private-equity business models. The industry uses large amounts of debt, interest on which is tax-deductible, to acquire companies. So it has long been adept at minimising tax, both by...Continue reading

from Economics http://ift.tt/2o9cXJW

via https://ifttt.com/ IFTTT

No comments:

Post a Comment